Iceland's Viking Victory

(アイスランドのバイキング的大勝利)

By Ambrose Evans-Pritchard

Telegraph Blog: February 17th, 2012

(アイスランドのバイキング的大勝利)

By Ambrose Evans-Pritchard

Telegraph Blog: February 17th, 2012

Congratulations to Iceland.

アイスランドよ、よくやった。

Fitch has upgraded the country to investment grade BBB – with stable outlook, expecting government debt to peak at 100pc of GDP.

フィッチは投資適格格付のBBBまで同国を格上げした。

債務残高はGDP比100%がピークだろうと予測して、見通しは安定とした。

The OECD's latest forecast said growth will be 2.4pc this year, after 2.9pc in 2011.

OECDによる最新の成長予測は、2011年の2.9%を受けて、2012年を2.4%とした。

Unemployment will fall from 7pc last year to 6.1pc this year and then 5.3pc in 2013.

失業率は昨年の7%から今年は6.1%へ、そして2013年には5.3%へと下落するだろう。

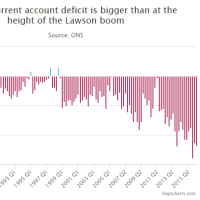

The current account deficit was 11.2pc in 2010. It will shrink to 3.4pc this year, and will be almost disappear next year.

2010年の経常赤字は11.2%だったが、これは今年3.4%まで縮小し、来年にはほぼゼロになると思われる。

The strategy of devaluation behind capital controls has rescued the economy. (Yes, I know there is a dispute about exchange controls, but that is a detail.) The country has held its Nordic welfare together and preserved social cohesion. It is slowly prospering again, though private debt weighs heavy.

資本規制の背後で展開された平価切り下げ戦略がアイスランドを救ったのだ。

(はい、為替管理への異論があるのは知ってますよ。でもささいなことだから。)

この国は北欧式の福利厚生を維持した上に、社会的一体性を保持した。

確かに民間部門の債務残高は膨大だが、ゆっくりと繁栄を取り戻しつつある。

Nobody is forcing the elected government out of office or appointing technocrats as prime minister. The Althingi sits untrammeled in its island glory, the oldest parliament in the world (930 AD).

選挙で選ばれた政権に退陣を強いる者もいなければ、技術系出身の閣僚を首相に任命する者もいない。

世界最古の議会(930年創設)であるアルシングは、縛られることなく国家の栄光に浴している。

The outcome is a vindication of sovereign currencies and national central banks able to respond to shocks.

この結果は、ソブリン通貨とその国独自の中央銀行はショックに対応することが出来るという証明だ。

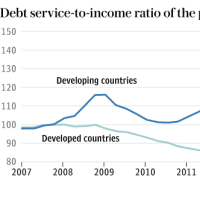

The contrast with the unemployment catastrophe and debt-deflation spirals across Europe's arc of depression is by now crystal clear. Those EMU shroud-wavers who persist in arguing that exit from the Europe would be suicidal will have to start coming up with a better argument.

欧州全域を飲み込む不況による大量失業と債務デフレ・スパイラルとの差は、今や火を見るよりも明らかだ。

欧州から飛び出すことは自殺行為だとしつこく主張するEMUの煙幕屋は、そろそろもっとましな言い分を考え始めなければならなくなるだろう。

Is it now so clear the Iceland will join the EU and the euro? Don't bet on it.

今やアイスランドがEUとユーロに参加するのは明白だ?

ありえないから。

Here is the Fitch text:

フィッチのコメントを読んでみよう。Fitch Ratings has upgraded Iceland's Long-term foreign currency Issuer Default Rating (IDR) to 'BBB-' from 'BB+' and affirmed its Long-term local currency IDR at 'BBB+'. Its Short-term foreign currency IDR has also been upgraded to 'F3' from 'B' and its Country Ceiling to 'BBB-' from 'BB+'. The Outlooks on the Long-term ratings are Stable.

フィッチはアイスランドの外貨建て長期IDRを「BBB-」から「BB+」に格上げし、自国通貨建てIDRを「BBB+」に据え置いた。外貨建て短期IDRも「B」から「F3」に、カントリー・シーリングを「BB+」から「BBB-」に格上げした。アウトルックは「安定的」とした。

以下翻訳文略

"The restoration of Iceland's Long-term foreign currency rating to investment grade reflects the progress that has been made in restoring macroeconomic stability, pushing ahead with structural reform and rebuilding sovereign creditworthiness since the 2008 banking and currency crisis," says Paul Rawkins, Senior Director in Fitch's Sovereign Rating Group.

"Iceland has successfully exited its IMF programme and gained renewed access to international capital markets. A promising economic recovery is underway, financial sector restructuring is well-advanced, while public debt/GDP appears to be close to peaking on the back of a robust fiscal consolidation programme," added Rawkins.

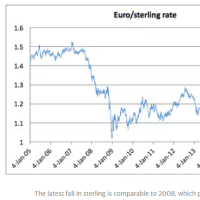

As the first country to suffer the full force of the global financial crisis, Iceland successfully completed a three-year IMF-supported rescue programme in August 2011. Despite some setbacks along the way, the programme laid the foundations for renewed access to international capital markets in mid-2011 and an encouraging rebound in economic growth to 3% for 2011 as a whole. Flexible labour and product markets and a floating exchange rate have facilitated the correction of external imbalances and contained the rise in unemployment, while the financial system has shrunk to one fifth of its former size.

Iceland has been among the front runners on fiscal consolidation in advanced economies: the primary deficit has contracted from 6.5% of GDP in 2009 to 0.5% in 2011 and Iceland appears to be on track to attain primary fiscal surpluses from 2012 and headline surpluses from 2014.

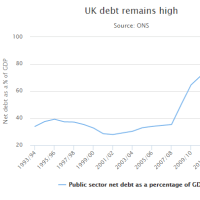

Fitch believes that gross general government debt may have peaked at around 100% of GDP in 2011 (excluding potential Icesave liabilities); net debt is significantly lower at around 65% of GDP, reflecting appreciable deposits at the Central Bank (CBI). Barring further shocks, Iceland should see a sustained reduction in its public debt/GDP ratio from 2012, assuming economic recovery continues and the government adheres to its medium term fiscal targets. Ample general government deposits at the CBI and record foreign exchange reserves

ameliorate near-term fiscal financing concerns. However, the risk of additional contingent liabilities migrating to the sovereign's balance sheet remains high.

Iceland's unorthodox crisis policy response has succeeded in preserving sovereign creditworthiness in the face of unprecedented financial sector distress. However, legacy issues remain, notably the protracted dispute over Icesave, an offshore branch of the failed Landsbanki that accepted foreign exchange deposits in the UK and the Netherlands, and the slow unwinding of capital controls imposed in 2008.

The impact of Icesave on Iceland's sovereign creditworthiness has diminished over time and Landsbanki has begun to remunerate deposit liabilities. Nonetheless, Fitch considers that Icesave still has the capacity to raise public debt by 6%-13% of GDP, should an EFTA Court ruling go against Iceland. Resolution of Icesave will be important for restoring normal relations with external creditors and removing this uncertainty for public finances.

Capital controls continue to block repatriation of USD3bn-USD4bn of non-resident investment in ISK-denominated public debt and deposit instruments. Fitch acknowledges that Iceland's exit from capital controls promises to be lengthy, given the underlying risks to macroeconomic stability, fiscal financing and the newly restructured commercial banks' deposit base.

So far, Iceland has been relatively unaffected by the eurozone sovereign debt crisis and, although growth is expected to slow to 2%-2.5% in 2012-13, Fitch does not expect Iceland to slip back into recession. However, the private sector remains heavily indebted – household debt exceeds 200% of disposable income and corporate debt 210% of GDP – highlighting the need for further domestic debt restructuring, while the key export sector has been held back by capacity constraints and a lack of investment exacerbated in part by the slow unwinding of capital controls.

Fitch says that future sovereign rating actions will take a broad range of factors into account including continued economic recovery and fiscal consolidation and progress towards public and external debt reduction. Iceland is still a relatively high income country with standards of governance, human development and ease of doing business more akin to a high grade sovereign than low investment grade. Accelerated private sector domestic debt restructuring, a progressive unwinding of capital controls, normalisation of relations with external creditors and enduring monetary and exchange rate stability would help to further advance Iceland's investment grade status.