2週間ほど前になってしまうが、Roubini教授がファイナンシャルタイムズに書いた記事を簡単に紹介したい(※1)。日本、ドイツなどに続き、米国のリセッションが終了するのは時間の問題とみられているが、注目はその後、である。

・this is a crisis of solvency, not just liquidity, but true deleveraging has not begun yet because the losses of financial institutions have been socialised and put on government balance sheets. This limits the ability of banks to lend, households to spend and companies to invest.

本当のデレバレッジはまだ始まっておらず、金融機関の損失は社会化され政府のバランスシートに載っている、というこの指摘は非常に重要。金融機関の貸付能力を制限しているという。結局、バブル後の日本と同じく不良債権は塩漬けされているが、政府支援策ははるかに大規模であるため、一旦景気後退が後退した、というのが真相であろう。これをいつどう解消するのか、次第で市場は大きな影響を受けるものと想定される(おそらくショックを与えない方法がとられるとすると、解決にかかる時間も長いものとなることが想定される)。

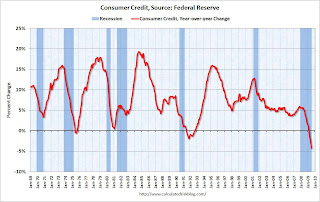

・in countries running current account deficits, consumers need to cut spending and save much more, yet debt-burdened consumers face a wealth shock from falling home prices and stock markets and shrinking incomes and employment.

経常収支が赤字の国(アメリカなど)にとって、消費者は消費を減らして貯蓄を増やす必要がある一方、消費者は住宅価格、株式価格、収入源、雇用減などのショックに直面している。

・the financial system – despite the policy support – is still severely damaged. Most of the shadow banking system has disappeared, and traditional banks are saddled with trillions of dollars in expected losses on loans and securities while still being seriously undercapitalised.

なお、※3のグリーンスパン氏の発言は、米銀の一段の資本強化の必要性と各国中銀による銀行システムへの大規模な流動性供給がインフレ圧力を高めるとの見方を示しており、Roubini氏と同じ点を指摘している。

T he global economy is starting to bottom out from the worst recession and financial crisis since the Great Depression. In the fourth quarter of 2008 and first quarter of 2009 the rate at which most advanced economies were contracting was similar to the gross domestic product free-fall in the early stage of the Depression. Then, late last year, policymakers who had been behind the curve finally started to use most of the weapons in their arsenal.

That effort worked and the free-fall of economic activity eased. There are three open questions now on the outlook. When will the global recession be over? What will be the shape of the economic recovery? Are there risks of a relapse?

On the first question it looks like the global economy will bottom out in the second half of 2009. In many advanced economies (the US, UK, Spain, Italy and other eurozone members) and some emerging market economies (mostly in Europe) the recession will not be formally over before the end of the year, as green shoots are still mixed with weeds. In some other advanced economies (Australia, Germany, France and Japan) and most emerging markets (China, India, Brazil and other parts of Asia and Latin America) the recovery has already started.

On the second issue the debate is between those – most of the economic consensus – who expect a V-shaped recovery with a rapid return to growth and those – like myself – who believe it will be U-shaped, anaemic and below trend for at least a couple of years, after a couple of quarters of rapid growth driven by the restocking of inventories and a recovery of production from near Depression levels.

There are several arguments for a weak U-shaped recovery . Employment is still falling sharply in the US and elsewhere – in advanced economies, unemployment will be above 10 per cent by 2010. This is bad news for demand and bank losses, but also for workers’ skills, a key factor behind long-term labour productivity growth.

Second, this is a crisis of solvency, not just liquidity, but true deleveraging has not begun yet because the losses of financial institutions have been socialised and put on government balance sheets. This limits the ability of banks to lend, households to spend and companies to invest.

Third, in countries running current account deficits, consumers need to cut spending and save much more, yet debt-burdened consumers face a wealth shock from falling home prices and stock markets and shrinking incomes and employment.

Fourth, the financial system – despite the policy support – is still severely damaged. Most of the shadow banking system has disappeared, and traditional banks are saddled with trillions of dollars in expected losses on loans and securities while still being seriously undercapitalised.

Fifth, weak profitability – owing to high debts and default risks, low growth and persistent deflationary pressures on corporate margins – will constrain companies’ willingness to produce, hire workers and invest.

Sixth, the releveraging of the public sector through its build-up of large fiscal deficits risks crowding out a recovery in private sector spending. The effects of the policy stimulus, moreover, will fizzle out by early next year, requiring greater private demand to support continued growth.

Seventh, the reduction of global imbalances implies that the current account deficits of profligate economies, such as the US, will narrow the surpluses of countries that over-save (China and other emerging markets, Germany and Japan). But if domestic demand does not grow fast enough in surplus countries, this will lead to a weaker recovery in global growth.

There are also now two reasons why there is a rising risk of a double-dip W-shaped recession. For a start, there are risks associated with exit strategies from the massive monetary and fiscal easing: policymakers are damned if they do and damned if they don’t. If they take large fiscal deficits seriously and raise taxes, cut spending and mop up excess liquidity soon, they would undermine recovery and tip the economy back into stag-deflation (recession and deflation).

But if they maintain large budget deficits, bond market vigilantes will punish policymakers. Then, inflationary expectations will increase, long-term government bond yields would rise and borrowing rates will go up sharply, leading to stagflation.

Another reason to fear a double-dip recession is that oil, energy and food prices are now rising faster than economic fundamentals warrant, and could be driven higher by excessive liquidity chasing assets and by speculative demand. Last year, oil at $145 a barrel was a tipping point for the global economy, as it created negative terms of trade and a disposable income shock for oil importing economies. The global economy could not withstand another contractionary shock if similar speculation drives oil rapidly towards $100 a barrel.

In summary, the recovery is likely to be anaemic and below trend in advanced economies and there is a big risk of a double-dip recession.

※2 世界経済、W字型リセッションに陥るリスク高い=NY大教授

http://jp.reuters.com/article/topNews/idJPJAPAN-11141920090824

・・・

「W」字型のリセッションに陥るリスクが高い理由の1つとして、各国政府が導入した大規模な景気対策からの出口戦略に伴うリスクを挙げ、「政府は出口戦略を実施してもしなくても困難に直面する」と述べた。

同教授は、政府が財政赤字を埋め合わせるために増税や歳出削減などを実施した場合、経済の回復を損ねる可能性があると指摘。一方で、巨額の財政赤字が放置されれば、インフレ懸念が高まり、国債利回りの上昇、ひいては借り入れコストの上昇につながり、結果として経済成長の足を引っ張ることになると警告した。

またもう1つの理由として、エネルギー・食料価格の上昇を挙げた。投機的な動きや流動性が過度に高まった場合、価格はさらに上昇する危険があると警告。投機的な動きにより原油価格が1バレル=100ドルに向け上昇した場合、世界経済は「さらなる打撃には耐えられない」と述べた。 ・・・・

※3 米銀、一段の資本強化が必要=グリーンスパン氏

http://jp.reuters.com/article/topNews/idJPJAPAN-11384920090907

・・・

「たとえユーフォリア(陶酔感)でも危機でもない状況下であっても、現在の水準よりも多くのバッファーが必要と考える」と述べた。

また、世界経済の大幅な緩みは食料品・燃料を除いたグローバルなインフレ率が来年初めまで低下することを示しているとする一方、各国中銀による銀行システムへの大規模な流動性供給がインフレ圧力を高めるとの見方を示した。

各国中銀が保有資産の大幅な増加を処理しない限り、インフレは上昇を始めるだろうとし、「(資産の処理は)非常に重要で実施する必要がある。簡単にはいかないだろう」と語った。

・・・