先日(2012年6月17日.日曜日)テレビをつけてみると、池上彰が芸能人相手にニュース解説をしている。どのようなテーマが選ばれ、どのようなテーマが選ばれないのかといったことはさておき、日本の中では比較的客観的で中立の立場に立とうとする番組なのでしょう。しかし、ギリシャの選挙の問題となると、一方的なギリシャ国民バッシングになってしまう。借金をして良い思いをしたクセに、借金返済に努力しないですまそうという国民がいるとは何事だ、今回のギリシャ選挙では「まともな奴(緊縮財政派)」が勝利しなければならない、そうでなければ「真面目な」日本人の迷惑にもなってしまうじゃないか! そんな感じに興奮してしまうような報道解説であった。

池上彰の番組だけがギリシャを非難しているわけではない。私の知る限り、どの日本語版でもギリシャ人が不真面目であると言っているものばかりである。

そう言いたい気持ちもわからない。しかし、ギリシャというのはヨーロッパの中では発展途上国だ。それなのにユーロ圏に組み込んでしまったことにドイツのような先進諸国に責任はないのか。私は素朴に疑問に思う。

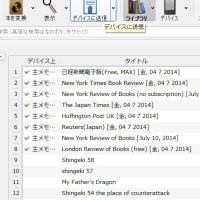

Facebook でニューヨーク・タイムズを見ていると、著名な経済学者 Krugmanが「犠牲者としてのギリシャ」という意見記事を書いている。日本語以外の言語情報に接触する重要性というのは、こういう記事を読むことではないかと思う。

Greece as Victim

By PAUL KRUGMAN

Published: June 17, 2012 398 Comments

Ever since Greece hit the skids, we’ve heard a lot about what’s wrong with everything Greek. Some of the accusations are true, some are false ― but all of them are beside the point. Yes, there are big failings in Greece’s economy, its politics and no doubt its society. But those failings aren’t what caused the crisis that is tearing Greece apart, and threatens to spread across Europe.

So, about those Greek failings: Greece does indeed have a lot of corruption and a lot of tax evasion, and the Greek government has had a habit of living beyond its means. Beyond that, Greek labor productivity is low by European standards ― about 25 percent below the European Union average. It’s worth noting, however, that labor productivity in, say, Mississippi is similarly low by American standards ― and by about the same margin.

On the other hand, many things you hear about Greece just aren’t true. The Greeks aren’t lazy ― on the contrary, they work longer hours than almost anyone else in Europe, and much longer hours than the Germans in particular. Nor does Greece have a runaway welfare state, as conservatives like to claim; social expenditure as a percentage of G.D.P., the standard measure of the size of the welfare state, is substantially lower in Greece than in, say, Sweden or Germany, countries that have so far weathered the European crisis pretty well.

So how did Greece get into so much trouble? Blame the euro.

ギリシャには確かに問題があるが、ギリシャの危機をもたらしたのはユーロの方である。

Fifteen years ago Greece was no paradise, but it wasn’t in crisis either. Unemployment was high but not catastrophic, and the nation more or less paid its way on world markets, earning enough from exports, tourism, shipping and other sources to more or less pay for its imports.

ユーロに加わる前、ギリシャは決して天国では無かったが、壊滅的な状況では無かった。

Then Greece joined the euro, and a terrible thing happened: people started believing that it was a safe place to invest. Foreign money poured into Greece, some but not all of it financing government deficits; the economy boomed; inflation rose; and Greece became increasingly uncompetitive. To be sure, the Greeks squandered much if not most of the money that came flooding in, but then so did everyone else who got caught up in the euro bubble.

And then the bubble burst, at which point the fundamental flaws in the whole euro system became all too apparent.

ユーロに加わったので、ギリシャにはヨーロッパの金が過剰に流入しバブルになると、経済は競争力を失ってしまった。だが、バブルがはじけしまうと、大問題が明らかになる。

Ask yourself, why does the dollar area ― also known as the United States of America ― more or less work, without the kind of severe regional crises now afflicting Europe? The answer is that we have a strong central government, and the activities of this government in effect provide automatic bailouts to states that get in trouble.

Consider, for example, what would be happening to Florida right now, in the aftermath of its huge housing bubble, if the state had to come up with the money for Social Security and Medicare out of its own suddenly reduced revenues. Luckily for Florida, Washington rather than Tallahassee is picking up the tab, which means that Florida is in effect receiving a bailout on a scale no European nation could dream of.

Or consider an older example, the savings and loan crisis of the 1980s, which was largely a Texas affair. Taxpayers ended up paying a huge sum to clean up the mess ― but the vast majority of those taxpayers were in states other than Texas. Again, the state received an automatic bailout on a scale inconceivable in modern Europe.

アメリカ合衆国の場合には貧しい南部の州があるが、ワシントンには強力な中央政府が存在する。これはEUにはないモノである。 (以下略)

So Greece, although not without sin, is mainly in trouble thanks to the arrogance of European officials, mostly from richer countries, who convinced themselves that they could make a single currency work without a single government. And these same officials have made the situation even worse by insisting, in the teeth of the evidence, that all the currency’s troubles were caused by irresponsible behavior on the part of those Southern Europeans, and that everything would work out if only people were willing to suffer some more.

Which brings us to Sunday’s Greek election, which ended up settling nothing. The governing coalition may have managed to stay in power, although even that’s not clear (the junior partner in the coalition is threatening to defect). But the Greeks can’t solve this crisis anyway.

The only way the euro might ― might ― be saved is if the Germans and the European Central Bank realize that they’re the ones who need to change their behavior, spending more and, yes, accepting higher inflation. If not ― well, Greece will basically go down in history as the victim of other people’s hubris.

A version of this op-ed appeared in print on June 18, 2012, on page A23 of the New York edition with the headline: Greece As Victim.

池上彰の番組だけがギリシャを非難しているわけではない。私の知る限り、どの日本語版でもギリシャ人が不真面目であると言っているものばかりである。

そう言いたい気持ちもわからない。しかし、ギリシャというのはヨーロッパの中では発展途上国だ。それなのにユーロ圏に組み込んでしまったことにドイツのような先進諸国に責任はないのか。私は素朴に疑問に思う。

Facebook でニューヨーク・タイムズを見ていると、著名な経済学者 Krugmanが「犠牲者としてのギリシャ」という意見記事を書いている。日本語以外の言語情報に接触する重要性というのは、こういう記事を読むことではないかと思う。

Greece as Victim

By PAUL KRUGMAN

Published: June 17, 2012 398 Comments

Ever since Greece hit the skids, we’ve heard a lot about what’s wrong with everything Greek. Some of the accusations are true, some are false ― but all of them are beside the point. Yes, there are big failings in Greece’s economy, its politics and no doubt its society. But those failings aren’t what caused the crisis that is tearing Greece apart, and threatens to spread across Europe.

So, about those Greek failings: Greece does indeed have a lot of corruption and a lot of tax evasion, and the Greek government has had a habit of living beyond its means. Beyond that, Greek labor productivity is low by European standards ― about 25 percent below the European Union average. It’s worth noting, however, that labor productivity in, say, Mississippi is similarly low by American standards ― and by about the same margin.

On the other hand, many things you hear about Greece just aren’t true. The Greeks aren’t lazy ― on the contrary, they work longer hours than almost anyone else in Europe, and much longer hours than the Germans in particular. Nor does Greece have a runaway welfare state, as conservatives like to claim; social expenditure as a percentage of G.D.P., the standard measure of the size of the welfare state, is substantially lower in Greece than in, say, Sweden or Germany, countries that have so far weathered the European crisis pretty well.

So how did Greece get into so much trouble? Blame the euro.

ギリシャには確かに問題があるが、ギリシャの危機をもたらしたのはユーロの方である。

Fifteen years ago Greece was no paradise, but it wasn’t in crisis either. Unemployment was high but not catastrophic, and the nation more or less paid its way on world markets, earning enough from exports, tourism, shipping and other sources to more or less pay for its imports.

ユーロに加わる前、ギリシャは決して天国では無かったが、壊滅的な状況では無かった。

Then Greece joined the euro, and a terrible thing happened: people started believing that it was a safe place to invest. Foreign money poured into Greece, some but not all of it financing government deficits; the economy boomed; inflation rose; and Greece became increasingly uncompetitive. To be sure, the Greeks squandered much if not most of the money that came flooding in, but then so did everyone else who got caught up in the euro bubble.

And then the bubble burst, at which point the fundamental flaws in the whole euro system became all too apparent.

ユーロに加わったので、ギリシャにはヨーロッパの金が過剰に流入しバブルになると、経済は競争力を失ってしまった。だが、バブルがはじけしまうと、大問題が明らかになる。

Ask yourself, why does the dollar area ― also known as the United States of America ― more or less work, without the kind of severe regional crises now afflicting Europe? The answer is that we have a strong central government, and the activities of this government in effect provide automatic bailouts to states that get in trouble.

Consider, for example, what would be happening to Florida right now, in the aftermath of its huge housing bubble, if the state had to come up with the money for Social Security and Medicare out of its own suddenly reduced revenues. Luckily for Florida, Washington rather than Tallahassee is picking up the tab, which means that Florida is in effect receiving a bailout on a scale no European nation could dream of.

Or consider an older example, the savings and loan crisis of the 1980s, which was largely a Texas affair. Taxpayers ended up paying a huge sum to clean up the mess ― but the vast majority of those taxpayers were in states other than Texas. Again, the state received an automatic bailout on a scale inconceivable in modern Europe.

アメリカ合衆国の場合には貧しい南部の州があるが、ワシントンには強力な中央政府が存在する。これはEUにはないモノである。 (以下略)

So Greece, although not without sin, is mainly in trouble thanks to the arrogance of European officials, mostly from richer countries, who convinced themselves that they could make a single currency work without a single government. And these same officials have made the situation even worse by insisting, in the teeth of the evidence, that all the currency’s troubles were caused by irresponsible behavior on the part of those Southern Europeans, and that everything would work out if only people were willing to suffer some more.

Which brings us to Sunday’s Greek election, which ended up settling nothing. The governing coalition may have managed to stay in power, although even that’s not clear (the junior partner in the coalition is threatening to defect). But the Greeks can’t solve this crisis anyway.

The only way the euro might ― might ― be saved is if the Germans and the European Central Bank realize that they’re the ones who need to change their behavior, spending more and, yes, accepting higher inflation. If not ― well, Greece will basically go down in history as the victim of other people’s hubris.

A version of this op-ed appeared in print on June 18, 2012, on page A23 of the New York edition with the headline: Greece As Victim.